09 Dic Conoce los llamados «aristócratas de los dividendos

Content

The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. In general, your distributions are subject to federal income tax when they are paid, whether you take them in cash or reinvest them in the Fund. Dividends paid out of the Fund’s income and net short-term gains, if any, are taxable as ordinary income.

- This is more than 200 times larger than the smallest S&P 500 companies, which have market caps between $6 billion and $7 billion.

- Index information does not reflect any management fees, transaction costs or expenses.

- Companies are selected for inclusion in the Index by Standard & Poor’s based on adequate liquidity, appropriate market capitalization, financial viability and public float.

- An index collects data from a variety of companies across industries.

- But companies’ profits don’t necessarily correlate with workers’ incomes, or workers’ economic happiness.

PrimeXBT products are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. The average annualized return since its inception in 1928 through December 31, 2021, is 11.82%.

More is possible with our ETFs

From another angle, the S&P 500, as an index, is a statistical measure of the performance of America’s 500 largest stocks. In this context, the S&P 500 is a common benchmark against which portfolio performance can be evaluated. Investments focused in a particular industry or sector, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments. ProShares Short S&P500 seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P 500®. However, you can find results by some analysts that include dividends, such as the list put together by Aswath Damodaran, a professor of finance at the NYU Stern School of Business. The total number tends to vary because there may be several companies with multiple share classes.

Taxes on distributions

In general, your distributions are subject to federal income tax when they are paid, whether you take them in cash or reinvest them in the Fund. Past performance is not a reliable indicator of future performance. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Performance of an index is not illustrative of any particular investment. All results are historical and assume the reinvestment of dividends and capital gains.

S&P Select Industry Indices Consultation on Constituent Weighting – Results

For specific tax advice, we recommend you speak with a qualified tax professional. Keep in mind that trading with margin may be subject to taxation. You are solely responsible for withholding, collecting, reporting, paying, settling and/or remitting any and all taxes to the appropriate tax authorities in such jurisdiction(s) in which You may be liable to pay tax. Investors buy and sell them like stocks, typically through a brokerage account.

In addition, you can buy S&P 500 futures, which trade on the Chicago Mercantile Exchange. These are essentially buy or sell options that enable hedging or speculating on the index’s future value. With that in mind, here’s a look at the 10 largest companies of the S&P 500 index as of January 2022. This list and its sequence can, and probably will, change over time. The S&P 500® Health Care comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector. ProShares ETFs (ProShares Trust and ProShares Trust II) are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor.

Together, that data forms a picture that helps investors compare current price levels with past prices to calculate market performance. For example, the Nasdaq index closely tracks the technology sector. So if you want to know how technology companies are performing, you’d want to look at the Nasdaq stock index. The S&P 500 is a widely used measure of large U.S. stock market performance. It includes a representative sample of leading companies in leading industries. Companies are selected for inclusion in the Index by Standard & Poor’s based on adequate liquidity, appropriate market capitalization, financial viability and public float.

What are stock market indexes?

Therefore, it’s more diverse in terms of the market caps represented. The first step to investing in the index is to open an account with a reputable brokerage firm such as Vanguard, Fidelity, TD Ameritrade, or Charles Schwab. Modern brokers have easy-to-use online platforms, where you can buy and sell most types of investments for minimal or no fees. Preferred stock is a breed of stock that gives investors a higher claim to assets and dividends from a company (compared to common shareholders), but usually no voting rights.

Get this delivered to your inbox, and more info about our products and services. The website primexbt.com is operated by PrimeXBT Trading Services LLC an entity that is not established in the EU or regulated by an EU National Competent Authority. MiFID II and there is no provision for an Investor Compensation Scheme. You will not benefit from the protections available to clients receiving regulated investment services. Performance returns for periods of less than one year are not annualized. (Also known as Mid Price) The price between the best price of the sellers for a trading unit of a given security and the best price of the buyer of a trading unit of a given security.

- Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold.

- One key point is that although these are 500 large companies, there’s a wide range of valuations.

- While it assumed its present size (and name) in 1957, the S&P actually dates back to the 1920s, becoming a composite index tracking 90 stocks in 1926.

- Robinhood Financial LLC (member SIPC), is a registered broker dealer.

- This list includes investable products traded on certain exchanges currently linked to this selection of indices.

Higher exposures are a bright color, while lower exposures are a dark color. The current factor exposures of the ETF relative to its benchmark index are shown using the bars in the chart. Each factor’s band indicates the +/- one standard deviation exposure of the fund to that factor over the past three years.

S&P 500 Index Defined & Discussed

The weighted harmonic average of current share price divided by the forecasted one year earnings per share for each security in the fund. The value of the S&P 500 index continuously fluctuates throughout the trading day based on performance-weighted market data for the underlying companies. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Shares of any ETF are generally bought and sold at market price (not NAV) and are not individually redeemed from the fund. Registered Investment Companies are required by the IRS to distribute substantially all of their income and capital gains to shareholders at least annually.

There is also the more popular Russell 2000 index, which is considered to be the best benchmark of how small-cap U.S. stocks are doing. Collectively, the Russell 1000 and Russell 2000 are known as the Russell 3000, which is a broad stock market benchmark index. Another key difference is that while the S&P 500 consists of large-cap stocks, the Nasdaq Composite contains all qualified stocks listed on the Nasdaq exchange.

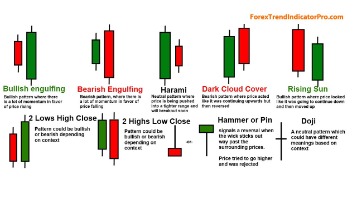

You can invest in the S&P 500 using index funds and exchange-traded funds that mimic the index and not pay as much as you would for each stock. Investing in funds that track the S&P 500 is a long game, not for the faint of heart—many investors have lost everything by panic selling during a dip. If you’re looking for an investment with a long-standing history of decent long-term returns, S&P 500 funds https://g-markets.net/helpful-articles/candle-signs-and-flame-meanings-for-candle-magic/ might be a suitable choice for your portfolio. For most people, the simplest and most affordable option for investing in the S&P 500 is to buy shares of an exchange-traded fund (ETF) or index fund that mirrors it. In these instruments, a company builds a portfolio of stocks that mirror the S&P 500 index, securitizes and fractionalizes those stocks, and offers them as shares of a fund you can buy.

What Is the Average Rate of Return for the S&P 500 for the Last 20 Years?

Since stock prices are driven primarily by companies’ abilities to generate profits, the S&P 500 will tend to rise as companies’ profits rise. But companies’ profits don’t necessarily correlate with workers’ incomes, or workers’ economic happiness. To calculate the proportion of weight a certain company has in the S&P 500, divide the company’s market cap by the total market cap of the S&P 500. For example, a company with a market cap of $50 billion when the S&P 500’s total market cap is $5 trillion has a 1% weighting.

Earnings per share (EPS) is one way to help measure a company’s profitability, by dividing how much money a company earns by the total number of shares. In finance, a rebound occurs when stock prices begin increasing after a period of decline. When the Fund is non-diversified, it may invest a relatively high percentage of its assets in a limited number of issuers. Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions. The obvious difference between the S&P 500 and the Nasdaq Composite Index is that stocks in the latter must be listed exclusively on the Nasdaq market. The S&P 500 is a mix of both Nasdaq and New York Stock Exchange (NYSE) stocks, as you can see in the top-10 list.

No hay comentarios